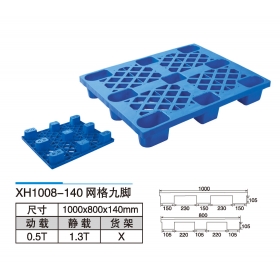

XH1008-140网格九脚

人气:9567面议

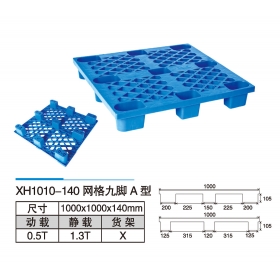

XH1010-140网格九脚A型

人气:10015面议

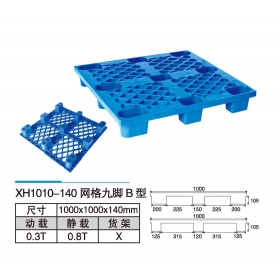

XH1010-140网格九脚B型

人气:9070面议

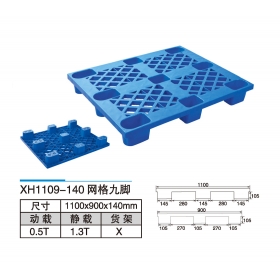

XH1109-140网格九脚

人气:10042面议

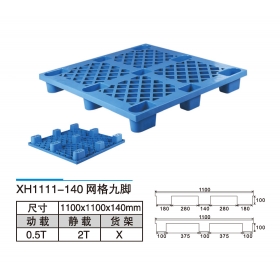

XH1111-140网格九脚

人气:9565面议

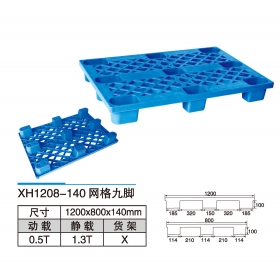

XH1208-140网格九脚

人气:9087面议

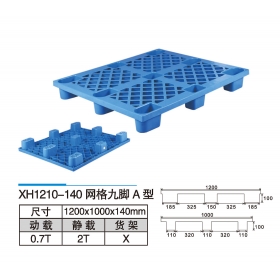

XH1210-140网格九脚A型

人气:9326面议

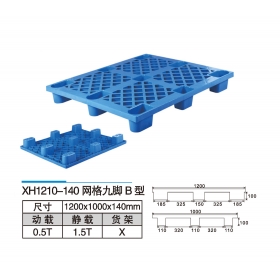

XH1210-140网格九脚B型

人气:8866面议

水箱30L

人气:5176面议

水箱70L

人气:8288面议

水箱90L

人气:8087面议

水箱120L

人气:7752面议

水箱140L

人气:7925面议

水箱160L

人气:7920面议

水箱200L

人气:8131面议

水箱300L

人气:8027面议

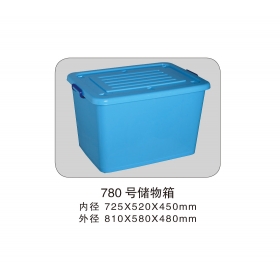

780号储物箱

人气:6666面议

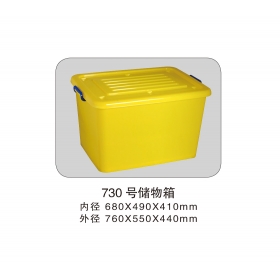

730号储物箱

人气:6588面议

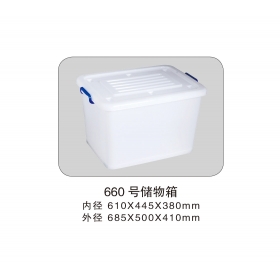

660号储物箱

人气:6579面议

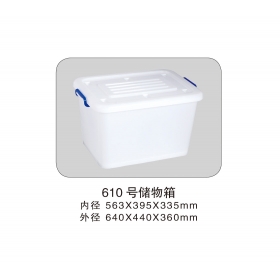

610号储物箱

人气:6695面议

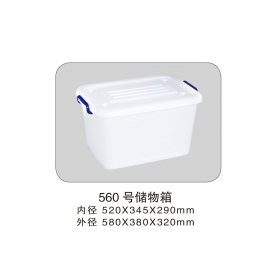

560号储物箱

人气:6534面议

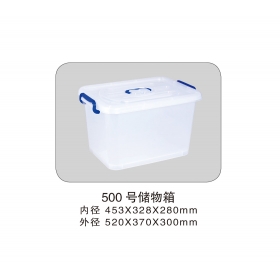

500号储物箱

人气:6598面议

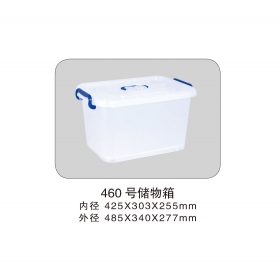

460号储物箱

人气:6625面议

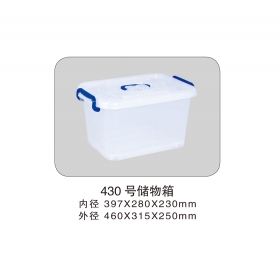

430号储物箱

人气:6607面议